Are you looking for a way to profit from a declining stock market? Do you have a strong conviction that a certain stock is overvalued and will eventually drop in price? If so, you might be interested in learning how to short sell a stock with CIBC Investor’s Edge.

Short selling is a technique that allows you to potentially make money from a falling stock price. But how does it work? And what are the risks and costs involved? In this article, we will explain the basics of short selling, how to do it online with Investor’s Edge, and what to consider before you enter a short sale.

What is Short Selling?

Short selling is the opposite of buying a stock. Instead of buying a stock and hoping that it will go up in value, you borrow a stock and sell it, hoping that it will go down in value. Then, you buy it back at a lower price and return it to the lender, keeping the difference as your profit.

For example, let’s say you believe that ABC stock is overpriced at $100 per share and will soon drop. You decide to short sell 100 shares of ABC stock with Investor’s Edge. You borrow the 100 shares from Investor’s Edge and sell them for $10,000. A few days later, ABC stock falls to $90 per share. You buy back the 100 shares for $9,000 and return them to Investor’s Edge. You have just made a profit of $1,000, minus any fees or commissions.

Sounds simple, right? Well, not so fast. Short selling is not as easy as it sounds. There are some important differences and challenges that you need to be aware of before you try it.

CIBC Investor Edge Broker Fees & Review

How to Short Sell a Stock Online with Investor’s Edge

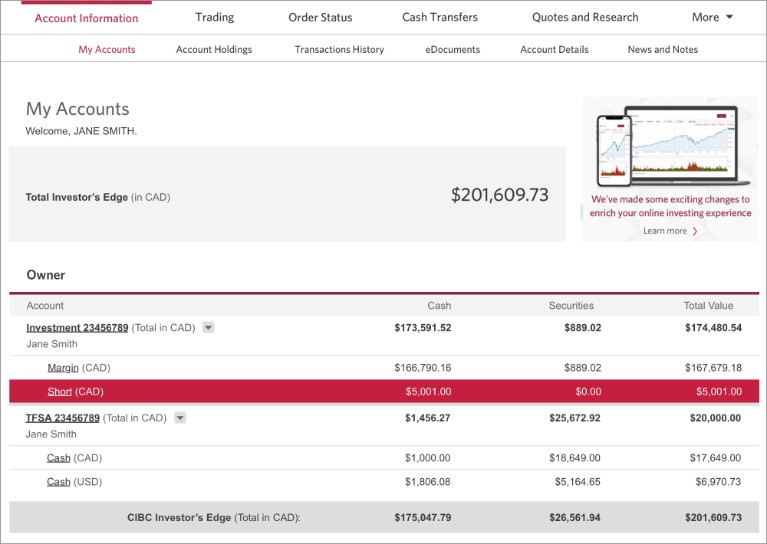

To short sell a stock online with Investor’s Edge, you need to have a margin account with enough assets to pledge as collateral for the borrowed securities. You also need to make sure that the stock you want to short sell is available for borrowing. Not all stocks are eligible for short selling, and the availability may change at any time.

Here are the steps to short sell a stock online with Investor’s Edge:

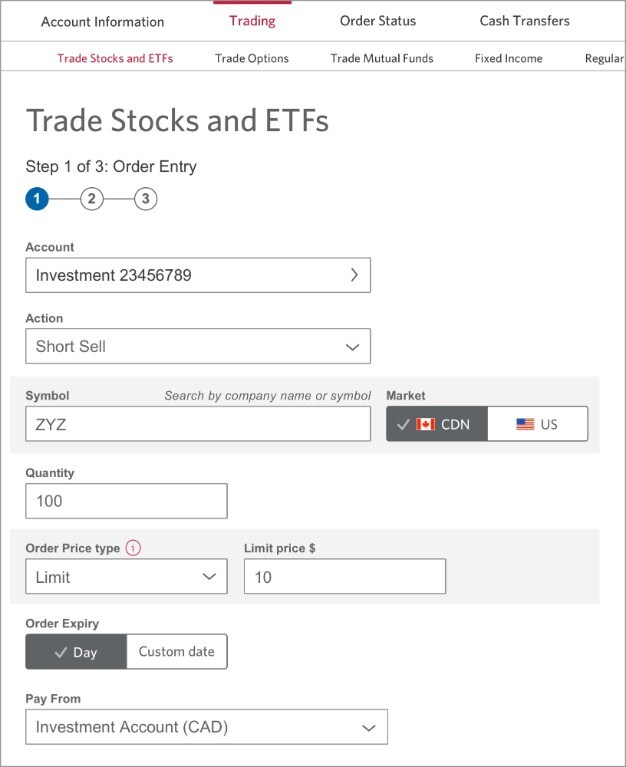

- Sign on to your Investor’s Edge account and select Trading from the navigation menu.

- Enter the stock symbol or company name of the stock you want to short sell in the Symbol box.

- Enter the number of shares you want to sell in the Quantity box.

- Select Sell Short from the Action dropdown menu.

- Select either Limit or Market as the Order Type from the dropdown menu. If you select Limit, you need to enter a limit price, which is the minimum price you are willing to accept for the sale.

- Choose the account that will receive the funds from the sale from the Account dropdown menu.

- Review and confirm your order details are correct and click Submit Order.

If your order is executed, you will see the short position in your account. You can monitor the performance of your short position and close it at any time by buying back the shares and returning them to Investor’s Edge.

Questrade Review: Unveiling the Pros and Cons of Canadian Investing

What to Consider Before Short Selling a Stock

Short selling a stock can be a profitable strategy, but it also comes with significant risks and costs. Here are some of the things you need to consider before short selling a stock:

- Unlimited loss potential. Unlike buying a stock, where your maximum loss is limited to the amount you invested, short selling a stock exposes you to unlimited loss potential. If the stock price rises instead of falls, you will lose money. And there is no limit to how high a stock price can go. For example, if you short sell 100 shares of ABC stock at $100 per share and the stock price jumps to $200 per share, you will lose $10,000, plus any fees or commissions. That is more than the $10,000 you received from the sale.

- Margin requirements. To short sell a stock, you need to have a margin account and maintain a certain amount of equity in your account. This is called the margin requirement, and it varies depending on the stock and the market conditions. If the stock price rises or the margin requirement changes, you may receive a margin call from Investor’s Edge, requiring you to deposit more money or securities into your account. If you fail to meet the margin call, Investor’s Edge may liquidate some or all of your positions without your consent.

- Borrowing costs. When you short sell a stock, you are borrowing it from Investor’s Edge. You have to pay interest on the borrowed stock, which is called the borrowing cost. The borrowing cost depends on the availability and demand of the stock, and it may change daily. The higher the borrowing cost, the more expensive it is to short sell the stock. You can view the borrowing cost of a stock on the Investor’s Edge website or by contacting Investor’s Edge.

- Dividend payments. When you short sell a stock that pays a dividend, you are responsible for paying that dividend to Investor’s Edge until you close your short position. This reduces your profit or increases your loss from the short sale. You can check the dividend history and schedule of a stock on the Investor’s Edge website or by contacting Investor’s Edge.

- Early recall. When you short sell a stock, you are borrowing it from Investor’s Edge, who in turn borrows it from another investor. The investor who lends the stock has the right to recall it at any time, for any reason. If this happens, Investor’s Edge will notify you and ask you to close your short position as soon as possible. This may force you to buy back the stock at an unfavorable price and incur a loss.

Conclusion

Short selling a stock with Investor’s Edge can be a way to profit from a declining stock market, but it also involves significant risks and costs. You need to have a margin account, meet the margin requirements, pay the borrowing costs and dividend payments, and be prepared for an early recall. You also need to be aware of the unlimited loss potential and the volatility of the stock price. Short selling is not suitable for everyone and should only be done with caution and research.

If you are interested in learning more about short selling or other trading strategies, you can visit the Investor’s Edge website or contact Investor’s Edge. You can also check out our other articles on investing and trading topics. We hope you found this article helpful and informative. Thank you for reading and happy investing!

Source: (1) How to Short Sell a Stock | CIBC Investor’s Edge. https://www.investorsedge.cibc.com/en/learn/trading-with-investors-edge/how-to-short-sell-stock.html. (2) Understanding Short Selling | CIBC. https://www.investorsedge.cibc.com/en/learn/investing/stocks/understanding-short-selling.html.