Our Opinion

CIBC Investor Edge is a great option for all kinds of investors, whether you’re a beginner or an advanced trader. One of the biggest advantages of this platform is its lower cost of online trading compared to other big banks.

In addition, the account maintenance fee can easily be avoided if your account balance is over $10,000. The platform is simple and user-friendly, with all the core features readily available in the navigation bar.

Customer experience is also a highlight of CIBC Investor Edge. Overall, if you’re looking for a platform that offers ease of use and cost-effectiveness, CIBC Investor Edge is an excellent option to consider.

Commissions & Pricing:

CIBC offers some of the lowest fees when compared to some of the major banks.

- $6.95 for online Equity and ETF trades

- $5.95 per trade for Students

- $4.95 per trade for active traders (more than 150 trades per quarter)

- For non-registered accounts, the margin rate for debit balances is 4% for CAD accounts and 4.5% for USD accounts. For a registered account, the margin rate for debit balances is 5% for CAD accounts and 5.5% for USD accounts. CIBC Investor’s Edge charges a minimum commission of $50 if you place a trade order by phone.

- Annual account maintenance fee of $100 if the account balance is lower than $10,000.

Note: Even if you’re starting your investing journey with just a few hundred dollars, you could quickly hit a $10,000 balance with regular contributions. This makes CIBC Investor’s Edge an affordable option, even for new investors.

Pros & Cons

| Pros | Cons |

| Buy and sell stocks, bonds, options, GICs, ETFs, mutual funds and precious metals certificates | You have to phone CIBC directly to access markets outside Canada and the US. |

| Active traders, young investors and students get discounted trades. No annual account fees for TFSAs and RESPs. | CIBC Investor’s Edge fees are low for a Big Bank, but it’s more expensive than discount brokerages. |

| Offers a rich array of research tools. | Offers a rich array of research tools. Can only fund via other CIBC accounts. You have to call to transfer from another bank. |

| No minimum investment amount | |

| Multilanguage services |

Eligibility

To open an account, you must meet the following requirements:

- Be of legal age in your province or territory of residence.

- Provide a valid phone number, residential address, and email address.

- Have an active bank account, with CIBC being the preferred option, to fund your account.

- Present a valid Social Insurance Number.

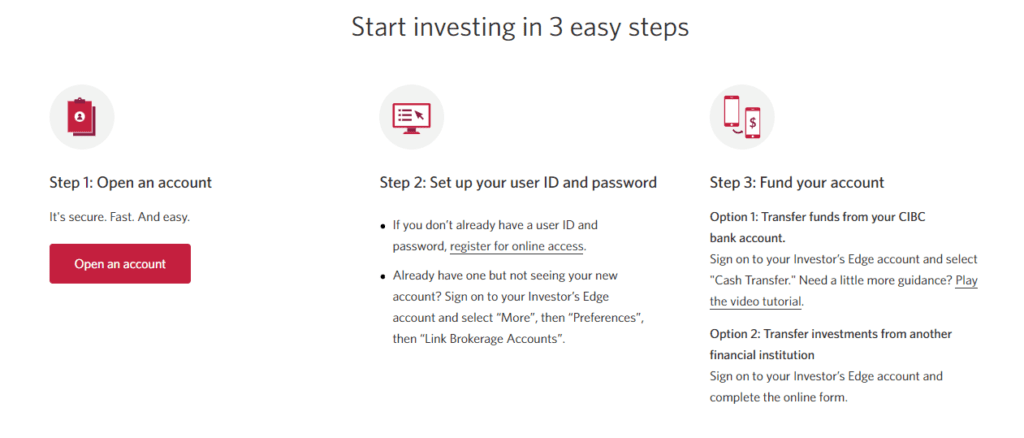

How to open an account with CIBC Investor’s Edge?

- Go to www.investorsedge.cibc.com and click on “Register”.

- Fill out the registration form with your personal information, financial details and account type preference.

- Choose a username and password for your account.

- Submit your application and wait for CIBC’s review. Please note that the process may take longer during high-volume times.

- Upon approval, complete verification and deposit funds to start trading.

Customer Service

CIBC Investor’s Edge excels in its service and support, providing customers with multiple communication channels for support. Customers can reach out through:

- Phone

- Online chat (with both automated and live agents),

- Mail, Email,

- Website contact form.

Additionally, the company offers special Mandarin and Cantonese support by phone through the Asian trading desk.

CIBC Investor Edges Top Features

CIBC Investor’s Edge is equipped with a range of features to benefit both beginner and experienced investors, including:

- Watch Lists: Create up to 20 custom lists to track your portfolio, stocks, and receive real-time quotes.

- Market Report: Receive a free daily email with actionable trading ideas.

- Email News Call: Stay informed with a daily email featuring the latest market information and sector-specific information for global companies, emerging markets, and more.

- Alerts: Track price movements and news announcements with customizable alerts.

- Charts: Advanced charting with various indicators and customizable studies.

- Cash Transfers: Schedule recurring transfers from your bank account to your CIBC Investor’s Edge account.

- Interactive Resources: Access extensive resources such as how-to guides, videos, webinars, and tutorials on trading.

- Research Reports: Benefit from reports from CIBC World Markets Inc. and trusted third-party sources to evaluate companies and equities.

Who Is CIBC Investor’s Edge Best For?

CIBC Investor’s Edge is good for all types of traders who want a platform with a lot of learning tools and resources. It is especially good for people who don’t mind paying extra fees for these resources and want to use a platform from one of Canada’s big banks.